403b withdrawal tax calculator

Or withdrawal from the starting minimum deposit balance will reduce actual earnings. Such as a 401k or 403b or funding a Roth or traditional IRA Oelker says.

2

Review exceptions to the 10 additional tax on early retirement plan distributions.

. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your 401k. A pre-tax 401k is an incredible opportunity to put your hard-earned money to work. Your earnings also wont be taxed until you withdraw them.

Using RMDs As Withdrawal Guidance. Because these funds were entirely deductible they would report 5500 in additional income on his 2016 tax return. Some fields are incomplete or the information is incorrect.

For example if you start contributing to a pre-tax 401k and put 5000 in the account through payroll contributions you wont have to pay income tax on that 5000 when tax season rolls around. Loan Credit Line Tax Savings Calculator. Your tax bracket based on your current earnings including the amount of the cash withdrawal from your.

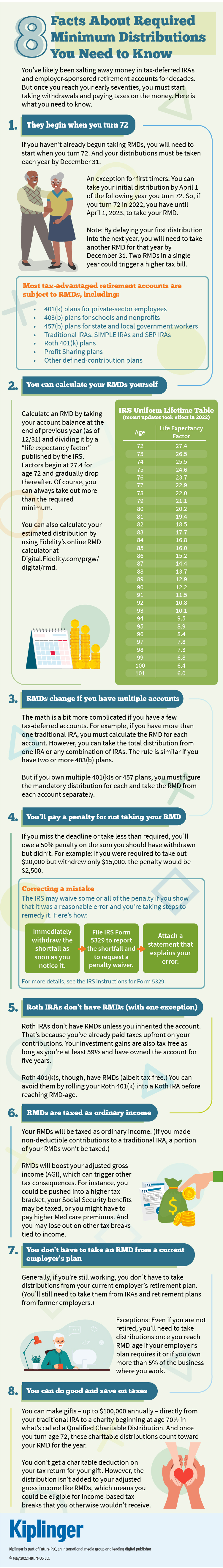

501c3 Corps including colleges universities schools hospitals. Required Minimum Withdrawals are established guidelines from the IRS for mandatory withdrawals from pre-tax retirement accounts starting at age 72 Uncle Sam wants his tax revenue after allI was surprised to find that 80 of those surveyed who are younger than RMD age took no withdrawals from their retirement. Use this 401k loan calculator to help calculate your 401k loan payments.

7 min read Sep 06 2022. For early withdrawal we may impose a penalty of 90 days dividends on. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the.

Both of these accounts allow for tax-deductible contributions and tax-free growth for employees with eligible income. If you are specifically interested in a 403b retirement plan check our 403b calculator. Employees of nonprofit organizations and state and local governments benefit from tax-advantaged retirement savings in 403b and 457b plans.

Enrollment can be completed at any time. Many workers employed by government entities and. One other piece to your puzzle is that your 403b grows tax-free while it is still in the account.

Cost of living comparison calculator. A 403b which is only available to employees of certain organizations has higher annual contribution limits while an IRA can offer a variety of options for tax and investment purposes. Calculate your earnings and more.

How to Work 401k Pre-tax Dollars to Your Advantage. 403b plans are only available for employees of certain non-profit tax-exempt organizations. SIPC only protects customers securities and.

If you have RMD questions please consult with your own tax advisor regarding your specific situation. If youre in the 20 percent combined state and federal tax bracket that will reduce your tax bill by 1000. Required Minimum Distributions Calculator.

However since youd likely be charged an early withdrawal penalty. TIAA-CREF Individual Institutional Services LLC Member FINRA Opens in a new window and SIPC Opens in a new window distributes securities products. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax.

Review Plan Highlights for a high level overview of the Plan. For example if you earn 50000 a year and contribute 5000 of your salary to a 401k youll shelter 5000 from state and federal income taxes that year. The TIAA group of companies does not provide legal or tax advice.

Please consult your tax or legal advisor to address your specific circumstances. Our income tax calculator calculates your federal state and local taxes based on several key inputs. A 403b plan allows eligible employees to save on a pre-tax or after-taxRoth basis through salary deduction.

4 ways to help you extend your savings Here are some top strategies for withdrawing your retirement funds from three planning experts. Once you are enrolled you may. 3 After-Tax Contributions.

A 401k loan is a way for someone to access cash from their 401k without tax consequences because the money is in the form of a loan. So for example if you cash out 10000 from your 401k and youre in the 22 percent federal tax bracket youll pay a total of 3200 in. Here are the 403b withdrawal rules.

Division O section 111 of PL. When you cash out your 401k before the age of 59 ½ youll be required to pay income tax on the full balance as well as a 10 percent early withdrawal penalty and any relevant state income tax. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Lets say someone converts an entirely deductible traditional IRA worth 5500 to a Roth IRA in 2016. 401k After-tax cost of debt Altman Z-Score. Not all retirement plans allow after-tax contributions.

Unless you made after-tax contributions you do have to pay tax for withdrawing retirement income. This includes direct contribution plans such as 401k 403b 457b plans and IRAs. If your plan allows after-tax contributions any contributions that you make must be included in your taxable income.

The tax and fees you are required to pay when cashing out a 403b are dependent on whether you cash out the 403b before or after the age of 59 12. Generally the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions. You will need to know the interest rate you are paying on your mortgage and student loans and.

How This 401k Loan Calculator Works. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. QRP such as a 401k 403b or governmental 457b.

Use the retirement withdrawal calculator to find out how long your money will last or how much money you can withdraw in retirement. Your household income location filing status and number of personal exemptions. This 401k loan calculator works with the user entering their specific information related to their 401k.

The tax impact of reported income can be reduced through various tax deductions or tax credits. These are generally non-Roth contributions that you choose to make in addition to your regular elective deferrals of salary.

403b Withdrawal Rules Pay Tax On Retirement Income

403b Calculator

Roth Ira Withdrawal Rules Oblivious Investor

Retirement Income Calculator Faq

The Cost Of Cashing Out Retirement Plans Early Equitable

8 Facts About Required Minimum Distributions You Need To Know

403 B Retirement Plan Questions And Answers About 403 B S

2

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Roth 403 B Plans Rules Tax Benefits And More Smartasset

401 A Vs 403 B What You Need To Know Smartasset

Withdrawing Money From An Annuity How To Avoid Penalties

403b Calculator Deals 59 Off Www Ingeniovirtual Com

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Can I Avoid Tax Hit On 403 B Withdrawal

Roth Ira Vs 403b Which Is Better 2022

Financial Calculators