35+ what percent of income is mortgage

Maximum allowable income is 115 of local median income. Were not including additional liabilities in estimating the.

What Percentage Of Your Income To Spend On A Mortgage

Top backend limit rises to.

. Heres how lenders typically view DTI. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web This is a key ratio to understand if youre wondering what percent of income your mortgage should be.

In that case NerdWallet recommends an annual pretax income of at least 184656. Some financial experts recommend other percentage models like the 3545 model. When determining what percentage of.

Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web If your down payment is 25001 or more you can find your maximum purchase price using this formula. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax.

Web The 3545 Model. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. 45 if were talking mortgage alone.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web If youd put 10 down on a 555555 home your mortgage would be about 500000. The 28 rule isnt universal.

A 20 down payment is ideal to lower your monthly. Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Web For example if you make 3500 a month your monthly mortgage should be no higher than 980 which would be 28 percent of your gross monthly income.

But the X factor is that we live in. Using a mortgage-to-income ratio no more than 28 of your. Estimate your monthly mortgage payment.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web But there are two other models that can be used. Compare Apply Directly Online.

Most home loans require a down payment of at least 3. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest.

Web According to the 2018 Consumer Financial Literacy Survey from the National Foundation for Credit Counseling 36 of senior citizens ages 65 and older have a mortgage with 7. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The amount of money you spend upfront to purchase a home.

This rule says you. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web Front-end only includes your housing payment.

36 DTI or lower. So around 6 of our gross income on the mortgagetaxes. Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio.

Down Payment Amount - 25000 10. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Most of the land mass of the nation outside of large cities qualify for USDA.

Check Todays Mortgage Rates at Top-Rated Lenders. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. Web Taxes are 104k for the whole year.

Ow8mislyku31mm

The Middle Class Crunch A Look At 4 Family Budgets The New York Times

Housing Expense Guideline For Financial Independence

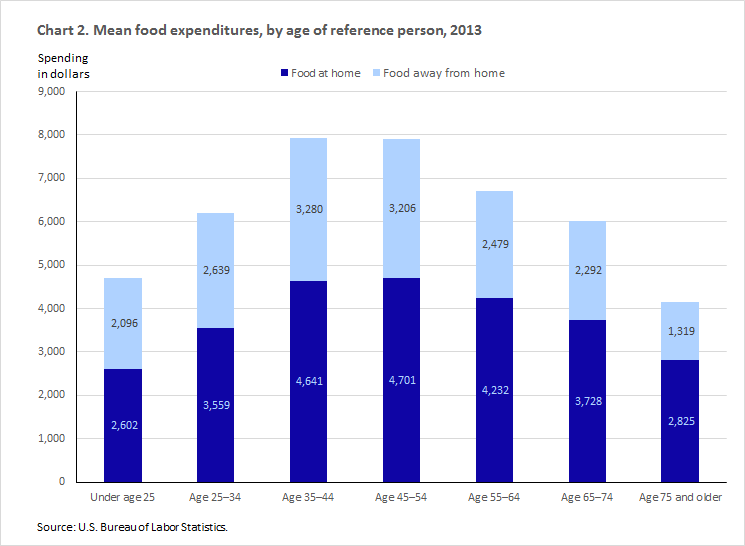

Consumer Expenditures Vary By Age Beyond The Numbers U S Bureau Of Labor Statistics

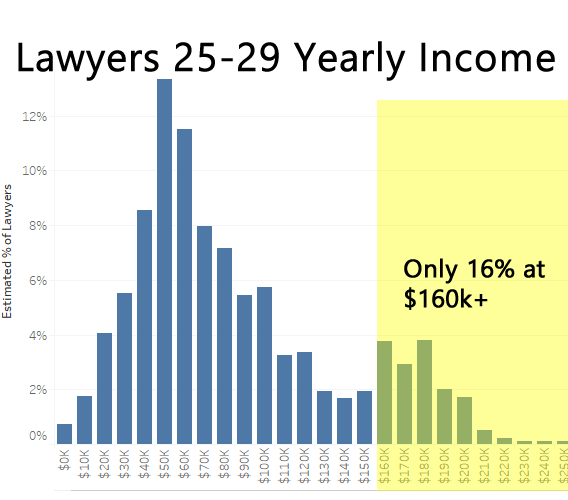

Are New Grad Law Salaries Actually Bi Modal Personal Finance Data

Nhaz1lfhobrlm

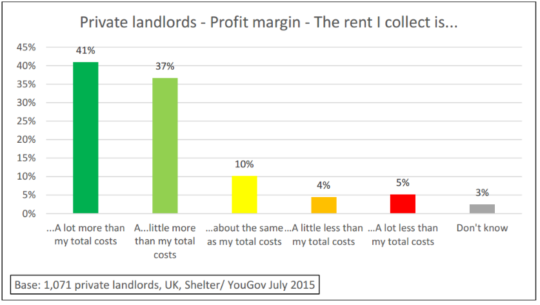

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

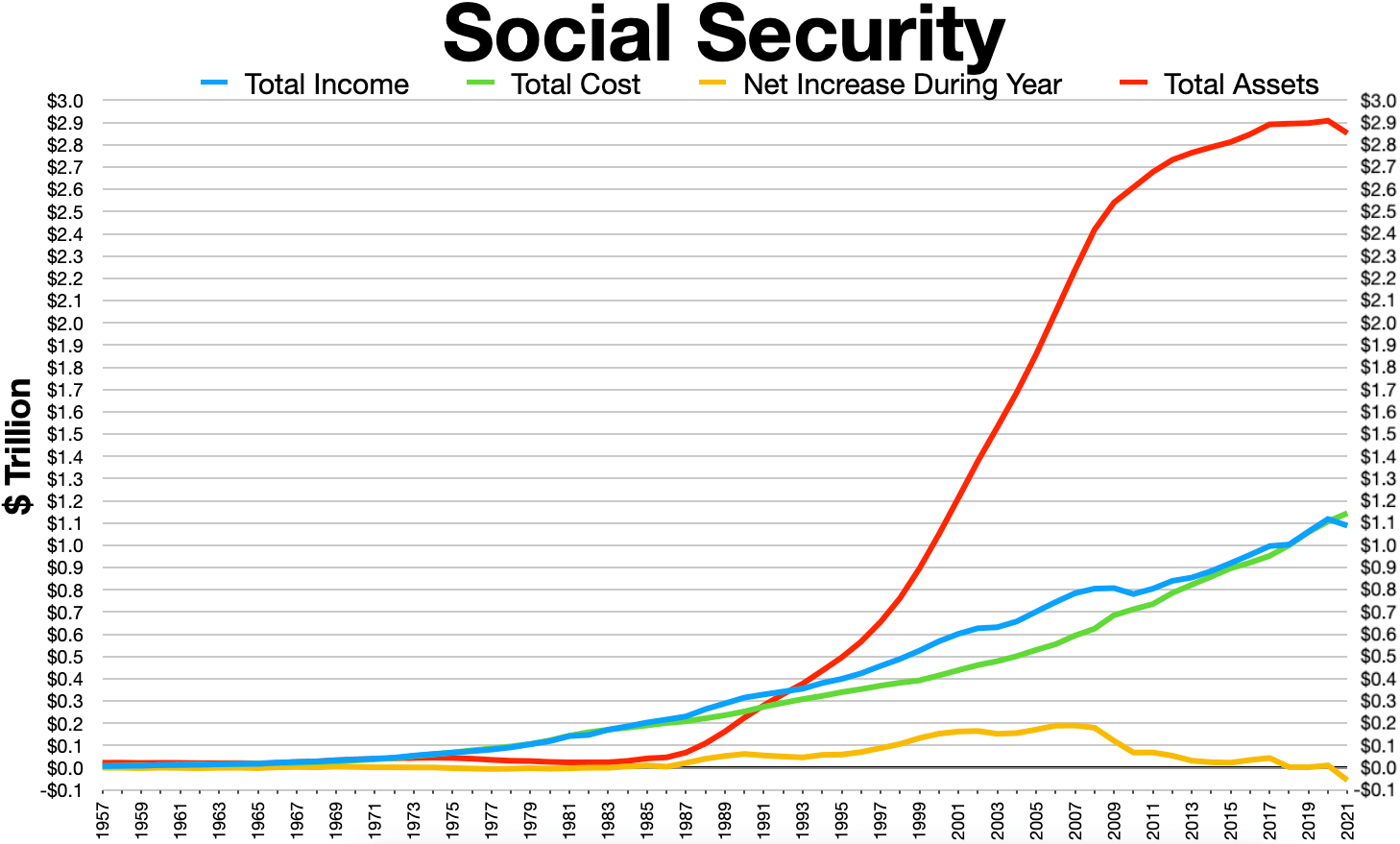

Social Security United States Wikiwand

Housing Affordability In Canada 2022 Re Max Report

Most Banks Move To 30 Year Conventional Amortizations Mortgage Rates Mortgage Broker News In Canada

35 Costly Medical Bankruptcy Statistics Etactics

The Percentage Of Income Rule For Mortgages Rocket Money

Percentage Of Income For Mortgage Payments Quicken Loans

What Percentage Of Your Income To Spend On A Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Of My Income Should Go Towards A Mortgage Payment

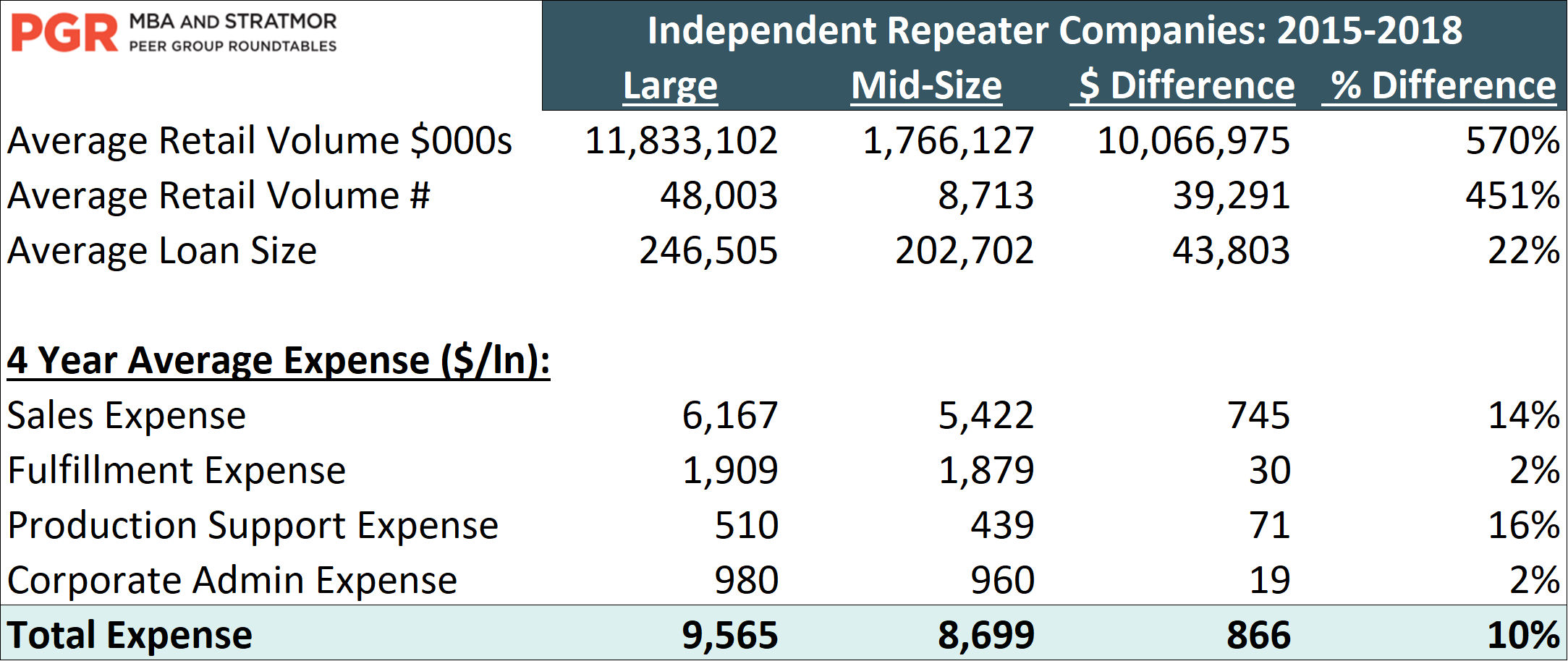

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group